Mage_Tax_Model_Mysql4_Calculation Class Reference

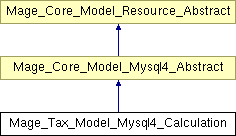

Inheritance diagram for Mage_Tax_Model_Mysql4_Calculation:

Public Member Functions | |

| deleteByRuleId ($ruleId) | |

| getDistinct ($field, $ruleId) | |

| getRate ($request) | |

| getCalculationProcess ($request, $rates=null) | |

| getRateIds ($request) | |

| getRatesByCustomerTaxClass ($customerTaxClass, $productTaxClass=null) | |

Protected Member Functions | |

| _construct () | |

| _getRates ($request) | |

| _calculateRate ($rates) | |

Detailed Description

Tax Calculation Resource Model

Definition at line 32 of file Calculation.php.

Member Function Documentation

| _calculateRate | ( | $ | rates | ) | [protected] |

Definition at line 153 of file Calculation.php.

00154 { 00155 $result = 0; 00156 $currentRate = 0; 00157 for ($i=0; $i<count($rates); $i++) { 00158 $rate = $rates[$i]; 00159 $rule = $rate['tax_calculation_rule_id']; 00160 $value = $rate['value']; 00161 $priority = $rate['priority']; 00162 00163 while(isset($rates[$i+1]) && $rates[$i+1]['tax_calculation_rule_id'] == $rule) { 00164 $i++; 00165 } 00166 00167 $currentRate += $value; 00168 00169 if (!isset($rates[$i+1]) || $rates[$i+1]['priority'] != $priority) { 00170 $result += (100+$result)*($currentRate/100); 00171 $currentRate = 0; 00172 } 00173 } 00174 00175 return $result; 00176 }

| _construct | ( | ) | [protected] |

Resource initialization

Reimplemented from Mage_Core_Model_Resource_Abstract.

Definition at line 34 of file Calculation.php.

00035 { 00036 $this->_setMainTable('tax/tax_calculation'); 00037 }

| _getRates | ( | $ | request | ) | [protected] |

Definition at line 127 of file Calculation.php.

00128 { 00129 $storeId = Mage::app()->getStore($request->getStore())->getId(); 00130 00131 $select = $this->_getReadAdapter()->select(); 00132 $select 00133 ->from(array('main_table'=>$this->getMainTable())) 00134 ->where('customer_tax_class_id = ?', $request->getCustomerClassId()) 00135 ->where('product_tax_class_id = ?', $request->getProductClassId()); 00136 00137 $select->join(array('rule'=>$this->getTable('tax/tax_calculation_rule')), 'rule.tax_calculation_rule_id = main_table.tax_calculation_rule_id', array('rule.priority', 'rule.position')); 00138 $select->join(array('rate'=>$this->getTable('tax/tax_calculation_rate')), 'rate.tax_calculation_rate_id = main_table.tax_calculation_rate_id', array('value'=>'rate.rate', 'rate.tax_country_id', 'rate.tax_region_id', 'rate.tax_postcode', 'rate.tax_calculation_rate_id', 'rate.code')); 00139 00140 $select 00141 ->where("rate.tax_country_id = ?", $request->getCountryId()) 00142 ->where("rate.tax_region_id in ('*', '', ?)", $request->getRegionId()) 00143 ->where("rate.tax_postcode in ('*', '', ?)", $request->getPostcode()); 00144 00145 $select->joinLeft(array('title_table'=>$this->getTable('tax/tax_calculation_rate_title')), "rate.tax_calculation_rate_id = title_table.tax_calculation_rate_id AND title_table.store_id = '{$storeId}'", array('title'=>'IFNULL(title_table.value, rate.code)')); 00146 00147 $order = array('rule.priority ASC', 'rule.tax_calculation_rule_id ASC', 'rate.tax_country_id DESC', 'rate.tax_region_id DESC', 'rate.tax_postcode DESC', 'rate.rate DESC'); 00148 $select->order($order); 00149 00150 return $this->_getReadAdapter()->fetchAll($select); 00151 }

| deleteByRuleId | ( | $ | ruleId | ) |

Definition at line 39 of file Calculation.php.

00040 { 00041 $conn = $this->_getWriteAdapter(); 00042 $where = $conn->quoteInto('tax_calculation_rule_id = ?', $ruleId); 00043 $conn->delete($this->getMainTable(), $where); 00044 }

| getCalculationProcess | ( | $ | request, | |

| $ | rates = null | |||

| ) |

Definition at line 58 of file Calculation.php.

00059 { 00060 if (is_null($rates)) { 00061 $rates = $this->_getRates($request); 00062 } 00063 00064 $result = array(); 00065 $row = array(); 00066 $ids = array(); 00067 $currentRate = 0; 00068 $totalPercent = 0; 00069 for ($i=0; $i<count($rates); $i++) { 00070 $rate = $rates[$i]; 00071 $value = (isset($rate['value']) ? $rate['value'] : $rate['percent'])*1; 00072 00073 $oneRate = array( 00074 'code'=>$rate['code'], 00075 'title'=>$rate['title'], 00076 'percent'=>$value, 00077 'position'=>$rate['position'], 00078 'priority'=>$rate['priority'], 00079 ); 00080 00081 00082 if (isset($rate['hidden'])) { 00083 $row['hidden'] = $rate['hidden']; 00084 } 00085 00086 if (isset($rate['amount'])) { 00087 $row['amount'] = $rate['amount']; 00088 } 00089 00090 if (isset($rate['base_amount'])) { 00091 $row['base_amount'] = $rate['base_amount']; 00092 } 00093 if (isset($rate['base_real_amount'])) { 00094 $row['base_real_amount'] = $rate['base_real_amount']; 00095 } 00096 $row['rates'][] = $oneRate; 00097 00098 if (isset($rates[$i+1]['tax_calculation_rule_id'])) { 00099 $rule = $rate['tax_calculation_rule_id']; 00100 } 00101 $priority = $rate['priority']; 00102 $ids[] = $rate['code']; 00103 00104 if (isset($rates[$i+1]['tax_calculation_rule_id'])) { 00105 while(isset($rates[$i+1]) && $rates[$i+1]['tax_calculation_rule_id'] == $rule) { 00106 $i++; 00107 } 00108 } 00109 00110 $currentRate += $value; 00111 00112 if (!isset($rates[$i+1]) || $rates[$i+1]['priority'] != $priority || (isset($rates[$i+1]['process']) && $rates[$i+1]['process'] != $rate['process'])) { 00113 $row['percent'] = (100+$totalPercent)*($currentRate/100); 00114 $row['id'] = implode($ids); 00115 $result[] = $row; 00116 $row = array(); 00117 $ids = array(); 00118 00119 $totalPercent += (100+$totalPercent)*($currentRate/100); 00120 $currentRate = 0; 00121 } 00122 } 00123 00124 return $result; 00125 }

| getDistinct | ( | $ | field, | |

| $ | ruleId | |||

| ) |

Definition at line 46 of file Calculation.php.

00047 { 00048 $select = $this->_getReadAdapter()->select(); 00049 $select->from($this->getMainTable(), $field)->where('tax_calculation_rule_id = ?', $ruleId); 00050 return $this->_getReadAdapter()->fetchCol($select); 00051 }

| getRate | ( | $ | request | ) |

Definition at line 53 of file Calculation.php.

00054 { 00055 return $this->_calculateRate($this->_getRates($request)); 00056 }

| getRateIds | ( | $ | request | ) |

Definition at line 178 of file Calculation.php.

00179 { 00180 $result = array(); 00181 $rates = $this->_getRates($request); 00182 for ($i=0; $i<count($rates); $i++) { 00183 $rate = $rates[$i]; 00184 $rule = $rate['tax_calculation_rule_id']; 00185 $result[] = $rate['tax_calculation_rate_id']; 00186 while(isset($rates[$i+1]) && $rates[$i+1]['tax_calculation_rule_id'] == $rule) { 00187 $i++; 00188 } 00189 } 00190 return $result; 00191 }

| getRatesByCustomerTaxClass | ( | $ | customerTaxClass, | |

| $ | productTaxClass = null | |||

| ) |

Definition at line 193 of file Calculation.php.

00194 { 00195 $calcJoinConditions = "calc_table.tax_calculation_rate_id = main_table.tax_calculation_rate_id"; 00196 $calcJoinConditions .= " AND calc_table.customer_tax_class_id = '{$customerTaxClass}'"; 00197 if ($productTaxClass) { 00198 $calcJoinConditions .= " AND calc_table.product_tax_class_id = '{$productTaxClass}'"; 00199 } 00200 00201 $selectCSP = $this->_getReadAdapter()->select(); 00202 $selectCSP->from(array('main_table'=>$this->getTable('tax/tax_calculation_rate')), array('country'=>'tax_country_id', 'region_id'=>'tax_region_id', 'postcode'=>'tax_postcode')) 00203 ->joinInner( 00204 array('calc_table'=>$this->getTable('tax/tax_calculation')), 00205 $calcJoinConditions, 00206 array('product_class'=>'calc_table.product_tax_class_id')) 00207 00208 ->joinLeft( 00209 array('state_table'=>$this->getTable('directory/country_region')), 00210 'state_table.region_id = main_table.tax_region_id', 00211 array('region_code'=>'state_table.code')) 00212 00213 ->distinct(true); 00214 00215 $CSP = $this->_getReadAdapter()->fetchAll($selectCSP); 00216 00217 $result = array(); 00218 foreach ($CSP as $one) { 00219 $request = new Varien_Object(); 00220 $request->setCountryId($one['country']) 00221 ->setRegionId($one['region_id']) 00222 ->setPostcode($one['postcode']) 00223 ->setCustomerClassId($customerTaxClass) 00224 ->setProductClassId($one['product_class']); 00225 00226 $rate = $this->getRate($request); 00227 if ($rate) { 00228 $row = array( 00229 'value' => $rate/100, 00230 'country' => $one['country'], 00231 'state' => $one['region_code'], 00232 'postcode' => $one['postcode'], 00233 'product_class' => $one['product_class'], 00234 ); 00235 00236 $result[] = $row; 00237 } 00238 } 00239 00240 return $result; 00241 }

The documentation for this class was generated from the following file:

- app/code/core/Mage/Tax/Model/Mysql4/Calculation.php

1.5.8

1.5.8