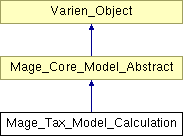

Mage_Tax_Model_Calculation Class Reference

Public Member Functions | |

| deleteByRuleId ($ruleId) | |

| getRates ($ruleId) | |

| getCustomerTaxClasses ($ruleId) | |

| getProductTaxClasses ($ruleId) | |

| getRate ($request) | |

| getRateRequest ($shippingAddress=null, $billingAddress=null, $customerTaxClass=null, $store=null) | |

| getRatesForAllProductTaxClasses ($request) | |

| getRatesForAllCustomerTaxClasses ($request) | |

| getAppliedRates ($request) | |

| reproduceProcess ($rates) | |

| getRatesByCustomerTaxClass ($customerTaxClass) | |

| getRatesByCustomerAndProductTaxClasses ($customerTaxClass, $productTaxClass) | |

Protected Member Functions | |

| _construct () | |

| _formCalculationProcess () | |

| _getRates ($request, $fieldName, $type) | |

Protected Attributes | |

| $_rates = array() | |

| $_ctc = array() | |

| $_ptc = array() | |

| $_rateCache = array() | |

| $_rateCalculationProcess = array() | |

Detailed Description

Tax Calculation Model

Definition at line 32 of file Calculation.php.

Member Function Documentation

| _construct | ( | ) | [protected] |

Enter description here...

Reimplemented from Varien_Object.

Definition at line 41 of file Calculation.php.

00042 { 00043 $this->_init('tax/calculation'); 00044 }

| _formCalculationProcess | ( | ) | [protected] |

Definition at line 76 of file Calculation.php.

00077 { 00078 $title = $this->getRateTitle(); 00079 $value = $this->getRateValue(); 00080 $id = $this->getRateId(); 00081 00082 $rate = array('code'=>$title, 'title'=>$title, 'percent'=>$value, 'position'=>1, 'priority'=>1); 00083 00084 $process = array(); 00085 $process['percent'] = $value; 00086 $process['id'] = "{$id}-{$value}"; 00087 $process['rates'][] = $rate; 00088 00089 return array($process); 00090 }

| _getRates | ( | $ | request, | |

| $ | fieldName, | |||

| $ | type | |||

| ) | [protected] |

Definition at line 182 of file Calculation.php.

00183 { 00184 $result = array(); 00185 $classes = Mage::getModel('tax/class')->getCollection() 00186 ->addFieldToFilter('class_type', $type) 00187 ->load(); 00188 foreach ($classes as $class) { 00189 $request->setData($fieldName, $class->getId()); 00190 $result[$class->getId()] = $this->getRate($request); 00191 } 00192 00193 return $result; 00194 }

| deleteByRuleId | ( | $ | ruleId | ) |

Definition at line 46 of file Calculation.php.

00047 { 00048 $this->getResource()->deleteByRuleId($ruleId); 00049 return $this; 00050 }

| getAppliedRates | ( | $ | request | ) |

Definition at line 205 of file Calculation.php.

00206 { 00207 $cacheKey = "{$request->getStore()->getId()}|{$request->getProductClassId()}|{$request->getCustomerClassId()}|{$request->getCountryId()}|{$request->getRegionId()}|{$request->getPostcode()}"; 00208 if (!isset($this->_rateCalculationProcess[$cacheKey])) { 00209 $this->_rateCalculationProcess[$cacheKey] = $this->_getResource()->getCalculationProcess($request); 00210 } 00211 return $this->_rateCalculationProcess[$cacheKey]; 00212 }

| getCustomerTaxClasses | ( | $ | ruleId | ) |

Definition at line 60 of file Calculation.php.

00061 { 00062 if (!isset($this->_ctc[$ruleId])) { 00063 $this->_ctc[$ruleId] = $this->getResource()->getDistinct('customer_tax_class_id', $ruleId); 00064 } 00065 return $this->_ctc[$ruleId]; 00066 }

| getProductTaxClasses | ( | $ | ruleId | ) |

Definition at line 68 of file Calculation.php.

00069 { 00070 if (!isset($this->_ptc[$ruleId])) { 00071 $this->_ptc[$ruleId] = $this->getResource()->getDistinct('product_tax_class_id', $ruleId); 00072 } 00073 return $this->_ptc[$ruleId]; 00074 }

| getRate | ( | $ | request | ) |

Definition at line 92 of file Calculation.php.

00093 { 00094 if (!$request->getCountryId() || !$request->getCustomerClassId() || !$request->getProductClassId()) { 00095 return 0; 00096 } 00097 00098 $cacheKey = "{$request->getProductClassId()}|{$request->getCustomerClassId()}|{$request->getCountryId()}|{$request->getRegionId()}|{$request->getPostcode()}"; 00099 if (!isset($this->_rateCache[$cacheKey])) { 00100 $this->unsRateValue(); 00101 $this->unsCalculationProcess(); 00102 $this->unsEventModuleId(); 00103 Mage::dispatchEvent('tax_rate_data_fetch', array('request'=>$this)); 00104 if (!$this->hasRateValue()) { 00105 $this->setCalculationProcess($this->_getResource()->getCalculationProcess($request)); 00106 $this->setRateValue($this->_getResource()->getRate($request)); 00107 } else { 00108 $this->setCalculationProcess($this->_formCalculationProcess()); 00109 } 00110 $this->_rateCache[$cacheKey] = $this->getRateValue(); 00111 $this->_rateCalculationProcess[$cacheKey] = $this->getCalculationProcess(); 00112 } 00113 return $this->_rateCache[$cacheKey]; 00114 }

| getRateRequest | ( | $ | shippingAddress = null, |

|

| $ | billingAddress = null, |

|||

| $ | customerTaxClass = null, |

|||

| $ | store = null | |||

| ) |

Definition at line 116 of file Calculation.php.

00117 { 00118 $address = new Varien_Object(); 00119 $session = Mage::getSingleton('customer/session'); 00120 $basedOn = Mage::getStoreConfig(Mage_Tax_Model_Config::CONFIG_XML_PATH_BASED_ON, $store); 00121 if (($shippingAddress === false && $basedOn == 'shipping') || ($billingAddress === false && $basedOn == 'billing')) { 00122 $basedOn = 'default'; 00123 } else { 00124 if ((($billingAddress === false || is_null($billingAddress) || !$billingAddress->getCountryId()) && $basedOn == 'billing') || (($shippingAddress === false || is_null($shippingAddress) || !$shippingAddress->getCountryId()) && $basedOn == 'shipping')){ 00125 if (!$session->isLoggedIn()) { 00126 $basedOn = 'default'; 00127 } else { 00128 $defBilling = $session->getCustomer()->getDefaultBillingAddress(); 00129 $defShipping = $session->getCustomer()->getDefaultShippingAddress(); 00130 00131 if ($basedOn == 'billing' && $defBilling && $defBilling->getCountryId()) { 00132 $billingAddress = $defBilling; 00133 } else if ($basedOn == 'shipping' && $defShipping && $defShipping->getCountryId()) { 00134 $shippingAddress = $defShipping; 00135 } else { 00136 $basedOn = 'default'; 00137 } 00138 } 00139 } 00140 } 00141 00142 switch ($basedOn) { 00143 case 'billing': 00144 $address = $billingAddress; 00145 break; 00146 00147 case 'shipping': 00148 $address = $shippingAddress; 00149 break; 00150 00151 case 'origin': 00152 $address 00153 ->setCountryId(Mage::getStoreConfig('shipping/origin/country_id', $store)) 00154 ->setRegionId(Mage::getStoreConfig('shipping/origin/region_id', $store)) 00155 ->setPostcode(Mage::getStoreConfig('shipping/origin/postcode', $store)); 00156 break; 00157 00158 case 'default': 00159 $address 00160 ->setCountryId(Mage::getStoreConfig(Mage_Tax_Model_Config::CONFIG_XML_PATH_DEFAULT_COUNTRY, $store)) 00161 ->setRegionId(Mage::getStoreConfig(Mage_Tax_Model_Config::CONFIG_XML_PATH_DEFAULT_REGION, $store)) 00162 ->setPostcode(Mage::getStoreConfig(Mage_Tax_Model_Config::CONFIG_XML_PATH_DEFAULT_POSTCODE, $store)); 00163 break; 00164 } 00165 00166 if (is_null($customerTaxClass) && $session->isLoggedIn()) { 00167 $customerTaxClass = $session->getCustomer()->getTaxClassId(); 00168 } elseif (($customerTaxClass === false) || !$session->isLoggedIn()) { 00169 $defaultCustomerGroup = Mage::getStoreConfig('customer/create_account/default_group', $store); 00170 $customerTaxClass = Mage::getModel('customer/group')->getTaxClassId($defaultCustomerGroup); 00171 } 00172 $request = new Varien_Object(); 00173 $request 00174 ->setCountryId($address->getCountryId()) 00175 ->setRegionId($address->getRegionId()) 00176 ->setPostcode($address->getPostcode()) 00177 ->setStore($store) 00178 ->setCustomerClassId($customerTaxClass); 00179 return $request; 00180 }

| getRates | ( | $ | ruleId | ) |

Definition at line 52 of file Calculation.php.

00053 { 00054 if (!isset($this->_rates[$ruleId])) { 00055 $this->_rates[$ruleId] = $this->getResource()->getDistinct('tax_calculation_rate_id', $ruleId); 00056 } 00057 return $this->_rates[$ruleId]; 00058 }

| getRatesByCustomerAndProductTaxClasses | ( | $ | customerTaxClass, | |

| $ | productTaxClass | |||

| ) |

Definition at line 224 of file Calculation.php.

00225 { 00226 return $this->getResource()->getRatesByCustomerTaxClass($customerTaxClass, $productTaxClass); 00227 }

| getRatesByCustomerTaxClass | ( | $ | customerTaxClass | ) |

Definition at line 219 of file Calculation.php.

00220 { 00221 return $this->getResource()->getRatesByCustomerTaxClass($customerTaxClass); 00222 }

| getRatesForAllCustomerTaxClasses | ( | $ | request | ) |

Definition at line 200 of file Calculation.php.

00201 { 00202 return $this->_getRates($request, 'customer_class_id', 'CUSTOMER'); 00203 }

| getRatesForAllProductTaxClasses | ( | $ | request | ) |

Definition at line 196 of file Calculation.php.

00197 { 00198 return $this->_getRates($request, 'product_class_id', 'PRODUCT'); 00199 }

| reproduceProcess | ( | $ | rates | ) |

Definition at line 214 of file Calculation.php.

00215 { 00216 return $this->getResource()->getCalculationProcess(null, $rates); 00217 }

Member Data Documentation

$_ctc = array() [protected] |

Definition at line 35 of file Calculation.php.

$_ptc = array() [protected] |

Definition at line 36 of file Calculation.php.

$_rateCache = array() [protected] |

Definition at line 38 of file Calculation.php.

$_rateCalculationProcess = array() [protected] |

Definition at line 39 of file Calculation.php.

$_rates = array() [protected] |

Definition at line 34 of file Calculation.php.

The documentation for this class was generated from the following file:

- app/code/core/Mage/Tax/Model/Calculation.php

1.5.8

1.5.8