Mage_Weee_Model_Total_Quote_Weee Class Reference

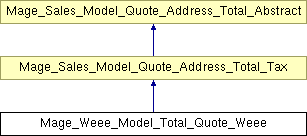

Inheritance diagram for Mage_Weee_Model_Total_Quote_Weee:

Public Member Functions | |

| __construct () | |

| collect (Mage_Sales_Model_Quote_Address $address) | |

| fetch (Mage_Sales_Model_Quote_Address $address) | |

Protected Member Functions | |

| _processItem (Mage_Sales_Model_Quote_Address $address, $item, $updateParent=false) | |

| _resetItemData ($item) | |

Detailed Description

Definition at line 28 of file Weee.php.

Constructor & Destructor Documentation

| __construct | ( | ) |

Reimplemented from Mage_Sales_Model_Quote_Address_Total_Tax.

Definition at line 30 of file Weee.php.

00030 { 00031 $this->setCode('weee'); 00032 }

Member Function Documentation

| _processItem | ( | Mage_Sales_Model_Quote_Address $ | address, | |

| $ | item, | |||

| $ | updateParent = false | |||

| ) | [protected] |

Definition at line 72 of file Weee.php.

00073 { 00074 $custTaxClassId = $address->getQuote()->getCustomerTaxClassId(); 00075 $store = $address->getQuote()->getStore(); 00076 00077 $taxCalculationModel = Mage::getSingleton('tax/calculation'); 00078 /* @var $taxCalculationModel Mage_Tax_Model_Calculation */ 00079 $request = $taxCalculationModel->getRateRequest($address, $address->getQuote()->getBillingAddress(), $custTaxClassId, $store); 00080 $defaultRateRequest = $taxCalculationModel->getRateRequest(false, false, false, $store); 00081 00082 $attributes = Mage::helper('weee')->getProductWeeeAttributes( 00083 $item->getProduct(), 00084 $address, 00085 $address->getQuote()->getBillingAddress(), 00086 $store->getWebsiteId() 00087 ); 00088 00089 $applied = array(); 00090 $productTaxes = array(); 00091 00092 foreach ($attributes as $k=>$attribute) { 00093 $baseValue = $attribute->getAmount(); 00094 $value = $store->convertPrice($baseValue); 00095 00096 $rowValue = $value*$item->getQty(); 00097 $baseRowValue = $baseValue*$item->getQty(); 00098 00099 $title = $attribute->getName(); 00100 00101 if ($item->getDiscountPercent() && Mage::helper('weee')->isDiscounted($store)) { 00102 $valueDiscount = $value/100*$item->getDiscountPercent(); 00103 $baseValueDiscount = $baseValue/100*$item->getDiscountPercent(); 00104 00105 $rowValueDiscount = $rowValue/100*$item->getDiscountPercent(); 00106 $baseRowValueDiscount = $baseRowValue/100*$item->getDiscountPercent(); 00107 00108 00109 // $value = $store->roundPrice($value-$valueDiscount); 00110 // $baseValue = $store->roundPrice($baseValue-$baseValueDiscount); 00111 // $rowValue = $store->roundPrice($rowValue-$rowValueDiscount); 00112 // $baseRowValue = $store->roundPrice($baseRowValue-$baseRowValueDiscount); 00113 00114 00115 $address->setDiscountAmount($address->getDiscountAmount()+$rowValueDiscount); 00116 $address->setBaseDiscountAmount($address->getBaseDiscountAmount()+$baseRowValueDiscount); 00117 00118 $address->setGrandTotal($address->getGrandTotal() - $rowValueDiscount); 00119 $address->setBaseGrandTotal($address->getBaseGrandTotal() - $baseRowValueDiscount); 00120 } 00121 00122 $oneDisposition = $baseOneDisposition = $disposition = $baseDisposition = 0; 00123 00124 if (Mage::helper('weee')->isTaxable($store)) { 00125 $currentPercent = $item->getTaxPercent(); 00126 $defaultPercent = $taxCalculationModel->getRate($defaultRateRequest->setProductClassId($item->getProduct()->getTaxClassId())); 00127 00128 $valueBeforeVAT = $rowValue; 00129 $baseValueBeforeVAT = $baseRowValue; 00130 00131 $oneDisposition = $store->roundPrice($value/(100+$defaultPercent)*$currentPercent); 00132 $baseOneDisposition = $store->roundPrice($baseValue/(100+$defaultPercent)*$currentPercent); 00133 00134 $disposition = $store->roundPrice($rowValue/(100+$defaultPercent)*$currentPercent); 00135 $baseDisposition = $store->roundPrice($baseRowValue/(100+$defaultPercent)*$currentPercent); 00136 00137 //$totalWeeeTax += $disposition; 00138 //$baseTotalWeeeTax += $baseDisposition; 00139 00140 $item->setBaseTaxAmount($item->getBaseTaxAmount()+$baseDisposition); 00141 $item->setTaxAmount($item->getTaxAmount()+$disposition); 00142 00143 00144 $value -= $oneDisposition; 00145 $baseValue -= $baseOneDisposition; 00146 00147 $rowValue -= $baseDisposition; 00148 $baseRowValue -= $disposition; 00149 00150 $item->setWeeeTaxDisposition($item->getWeeeTaxDisposition() + $oneDisposition); 00151 $item->setBaseWeeeTaxDisposition($item->getBaseWeeeTaxDisposition() + $baseOneDisposition); 00152 $item->setWeeeTaxRowDisposition($item->getWeeeTaxRowDisposition() + $disposition); 00153 $item->setBaseWeeeTaxRowDisposition($item->getBaseWeeeTaxRowDisposition() + $baseDisposition); 00154 00155 $item->setTaxBeforeDiscount($item->getTaxBeforeDiscount() + $disposition); 00156 $item->setBaseTaxBeforeDiscount($item->getBaseTaxBeforeDiscount() + $baseDisposition); 00157 00158 $address->setTaxAmount($address->getTaxAmount() + $disposition); 00159 $address->setBaseTaxAmount($address->getBaseTaxAmount() + $baseDisposition); 00160 00161 $rate = $taxCalculationModel->getRate($request->setProductClassId($item->getProduct()->getTaxClassId())); 00162 00163 $this->_saveAppliedTaxes( 00164 $address, 00165 $taxCalculationModel->getAppliedRates($request), 00166 $store->roundPrice($valueBeforeVAT-$rowValue), 00167 $store->roundPrice($baseValueBeforeVAT-$baseRowValue), 00168 $rate 00169 ); 00170 00171 $address->setGrandTotal($address->getGrandTotal() + $store->roundPrice($valueBeforeVAT-$rowValue)); 00172 $address->setBaseGrandTotal($address->getBaseGrandTotal() + $store->roundPrice($baseValueBeforeVAT-$baseRowValue)); 00173 } 00174 00175 if (Mage::helper('weee')->includeInSubtotal($store)) { 00176 $address->setSubtotal($address->getSubtotal() + $rowValue); 00177 $address->setBaseSubtotal($address->getBaseSubtotal() + $baseRowValue); 00178 00179 $address->setSubtotalWithDiscount($address->getSubtotalWithDiscount() + $rowValue); 00180 $address->setBaseSubtotalWithDiscount($address->getBaseSubtotalWithDiscount() + $baseRowValue); 00181 } else { 00182 $address->setTaxAmount($address->getTaxAmount() + $rowValue); 00183 $address->setBaseTaxAmount($address->getBaseTaxAmount() + $baseRowValue); 00184 } 00185 00186 00187 $productTaxes[] = array( 00188 'title'=>$title, 00189 'base_amount'=>$baseValue, 00190 'amount'=>$value, 00191 00192 'row_amount'=>$rowValue, 00193 'base_row_amount'=>$baseRowValue, 00194 00195 'base_amount_incl_tax'=>$baseValue+$baseOneDisposition, 00196 'amount_incl_tax'=>$value+$oneDisposition, 00197 00198 'row_amount_incl_tax'=>$rowValue+$disposition, 00199 'base_row_amount_incl_tax'=>$baseRowValue+$baseDisposition, 00200 ); 00201 00202 $applied[] = array( 00203 'id'=>$attribute->getCode(), 00204 'percent'=>null, 00205 'hidden'=>Mage::helper('weee')->includeInSubtotal($store), 00206 'rates' => array(array( 00207 'amount'=>$rowValue, 00208 'base_amount'=>$baseRowValue, 00209 'base_real_amount'=>$baseRowValue, 00210 'code'=>$attribute->getCode(), 00211 'title'=>$title, 00212 'percent'=>null, 00213 'position'=>1, 00214 'priority'=>-1000+$k, 00215 )) 00216 ); 00217 00218 $item->setBaseWeeeTaxAppliedAmount($item->getBaseWeeeTaxAppliedAmount() + $baseValue); 00219 $item->setBaseWeeeTaxAppliedRowAmount($item->getBaseWeeeTaxAppliedRowAmount() + $baseRowValue); 00220 00221 $item->setWeeeTaxAppliedAmount($item->getWeeeTaxAppliedAmount() + $value); 00222 $item->setWeeeTaxAppliedRowAmount($item->getWeeeTaxAppliedRowAmount() + $rowValue); 00223 } 00224 00225 Mage::helper('weee')->setApplied($item, array_merge(Mage::helper('weee')->getApplied($item), $productTaxes)); 00226 00227 if ($updateParent) { 00228 $parent = $item->getParentItem(); 00229 00230 $parent->setBaseWeeeTaxDisposition($parent->getBaseWeeeTaxDisposition() + $item->getBaseWeeeTaxDisposition()); 00231 $parent->setWeeeTaxDisposition($parent->getWeeeTaxDisposition() + $item->getWeeeTaxDisposition()); 00232 00233 $parent->setBaseWeeeTaxRowDisposition($parent->getBaseWeeeTaxRowDisposition() + $item->getBaseWeeeTaxRowDisposition()); 00234 $parent->setWeeeTaxRowDisposition($parent->getWeeeTaxRowDisposition() + $item->getWeeeTaxRowDisposition()); 00235 00236 $parent->setBaseWeeeTaxAppliedAmount($parent->getBaseWeeeTaxAppliedAmount() + $item->getBaseWeeeTaxAppliedAmount()); 00237 $parent->setBaseWeeeTaxAppliedRowAmount($parent->getBaseWeeeTaxAppliedRowAmount() + $item->getBaseWeeeTaxAppliedRowAmount()); 00238 00239 $parent->setWeeeTaxAppliedAmount($parent->getWeeeTaxAppliedAmount() + $item->getWeeeTaxAppliedAmount()); 00240 $parent->setWeeeTaxAppliedRowAmount($parent->getWeeeTaxAppliedRowAmount() + $item->getWeeeTaxAppliedRowAmount()); 00241 } 00242 00243 if ($applied) { 00244 $this->_saveAppliedTaxes( 00245 $address, 00246 $applied, 00247 $item->getWeeeTaxAppliedAmount(), 00248 $item->getBaseWeeeTaxAppliedAmount(), 00249 null 00250 ); 00251 } 00252 }

| _resetItemData | ( | $ | item | ) | [protected] |

Definition at line 254 of file Weee.php.

00255 { 00256 Mage::helper('weee')->setApplied($item, array()); 00257 00258 $item->setBaseWeeeTaxDisposition(0); 00259 $item->setWeeeTaxDisposition(0); 00260 00261 $item->setBaseWeeeTaxRowDisposition(0); 00262 $item->setWeeeTaxRowDisposition(0); 00263 00264 $item->setBaseWeeeTaxAppliedAmount(0); 00265 $item->setBaseWeeeTaxAppliedRowAmount(0); 00266 00267 $item->setWeeeTaxAppliedAmount(0); 00268 $item->setWeeeTaxAppliedRowAmount(0); 00269 }

| collect | ( | Mage_Sales_Model_Quote_Address $ | address | ) |

Collect totals process

- Parameters:

-

Mage_Sales_Model_Quote_Address $address

Child item's tax we calculate for parent

We calculate parent tax amount as sum of children's tax amounts

Reimplemented from Mage_Sales_Model_Quote_Address_Total_Tax.

Definition at line 34 of file Weee.php.

00035 { 00036 $totalWeeeTax = 0; 00037 $baseTotalWeeeTax = 0; 00038 00039 $items = $address->getAllItems(); 00040 if (!count($items)) { 00041 return $this; 00042 } 00043 00044 foreach ($items as $item) { 00045 if ($item->getParentItemId()) { 00046 continue; 00047 } 00048 00049 $this->_resetItemData($item); 00050 00051 if ($item->getHasChildren() && $item->isChildrenCalculated()) { 00052 foreach ($item->getChildren() as $child) { 00053 $this->_resetItemData($child); 00054 $this->_processItem($address, $child, true); 00055 00056 $totalWeeeTax += $child->getWeeeTaxAppliedRowAmount(); 00057 $baseTotalWeeeTax += $child->getBaseWeeeTaxAppliedRowAmount(); 00058 } 00059 } else { 00060 $this->_processItem($address, $item); 00061 00062 $totalWeeeTax += $item->getWeeeTaxAppliedRowAmount(); 00063 $baseTotalWeeeTax += $item->getBaseWeeeTaxAppliedRowAmount(); 00064 } 00065 } 00066 00067 $address->setGrandTotal($address->getGrandTotal() + $totalWeeeTax); 00068 $address->setBaseGrandTotal($address->getBaseGrandTotal() + $baseTotalWeeeTax); 00069 return $this; 00070 }

| fetch | ( | Mage_Sales_Model_Quote_Address $ | address | ) |

Fetch (Retrieve data as array)

- Parameters:

-

Mage_Sales_Model_Quote_Address $address

- Returns:

- array

Reimplemented from Mage_Sales_Model_Quote_Address_Total_Tax.

Definition at line 271 of file Weee.php.

The documentation for this class was generated from the following file:

- app/code/core/Mage/Weee/Model/Total/Quote/Weee.php

1.5.8

1.5.8